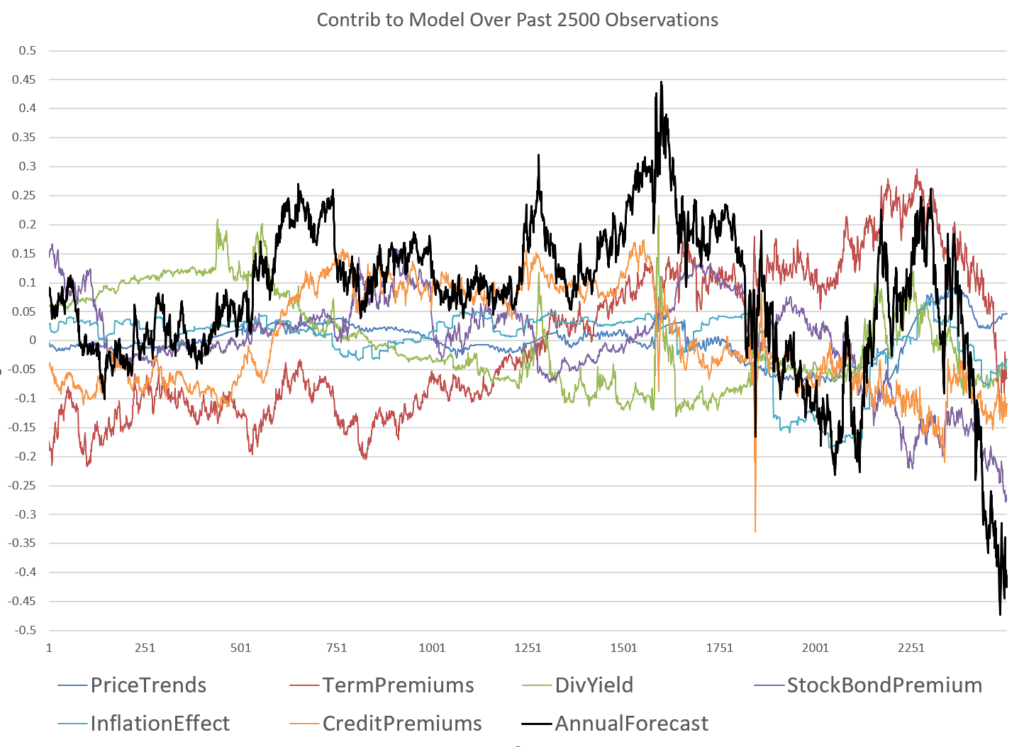

I created a breakdown of what is factoring into the current particularly bearish forecast for the annual model. I categorize the many model variables as falling into one of six categories: dividend yield, stock v bond, credit premiums, inflation, term (aka time) premiums, and price trends. Pretty much all the categories are weighing the model down in comparison to the average of their 2500 most recent observations with a lone exception of the price trend. Dividend yields v 10 year treasuries are creating the most downward pressure followed by credit premiums. Term premiums are the most rapidly changing category as the long end of the yield curve has been rising rapidly.